#EIN LOOK UP CHURCH VERIFICATION#

You'll be required to complete the telephonic verification to receive the EIN details. If you are a business owner, you can call the IRS at 80, Monday through Friday.

#EIN LOOK UP CHURCH FREE#

It's a free tool to look up an EIN of a listed company. The database contains all the SEC filings of publicly traded companies. You can view the public documents filed with the SEC through EDGAR - the Electronic Data Gathering, Analysis, and Retrieval system database.

The EIN appears at the top of these documents. Public companies are required to file periodic returns and earning updates with the U.S. However, smaller businesses often prefer to keep their EIN details confidential to prevent potential tax fraud. Most of the public companies include their EIN information in their financial documents like an earning statement. Many companies do not mind providing the EIN details over the phone to help their employees and contractors with tax filing. You can even call the company directly and ask for its employer identification number.

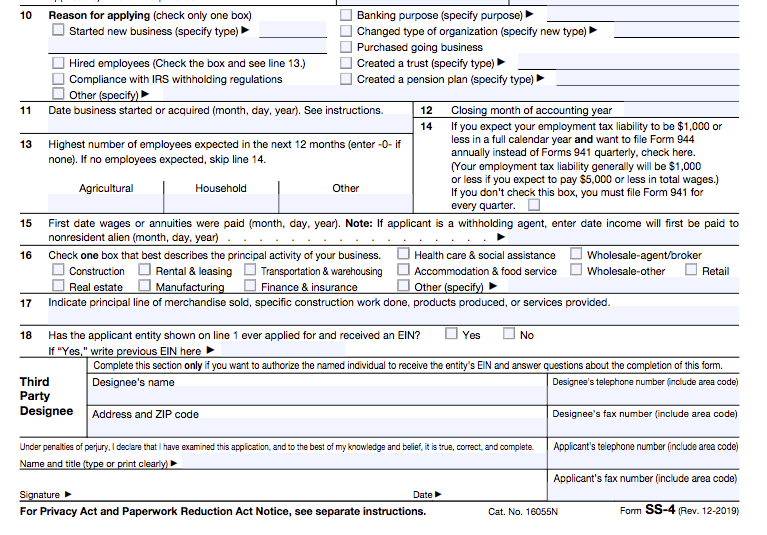

You will find the EIN at the top right corner of these forms alongside the name and address of the business. You can check the latest Form 1099 or W-2 provided by the business. Check the Tax Formsīusinesses often provide their EIN to their employees and contractors, who may require the number for filing their annual tax returns. Several commercial database providers often come up with special offers and let you conduct a few free searches before requiring you to sign up. If you regularly need to look up EINs, you may want to subscribe to a commercial database service. You should request EIN information only for legal use. However, note that illegal or unauthorized use of tax information that you collect may constitute a federal crime. You can use different resources for this purpose. Since most businesses including nonprofit organizations and state government agencies possess an EIN, you can use it to search for information about a particular business. An EIN provides business owners with an easy way of separating business tax compliance from their personal taxation. You'll need an EIN for purchasing or setting up a new business, changing the type of organization, and creating a trust, among others. The IRS assigns a tax ID, commonly known as Employer Identification Number (EIN), for the purpose of tracking federal tax compliance of business entities. How do I perform my EIN number lookup? You can get the EIN information of a business through several methods, including calling up the IRS service, checking tax forms, searching the SEC filings, and contacting the company in question.

0 kommentar(er)

0 kommentar(er)